Rolex prices are dropping faster than for any other brand on the secondary market, according to the Bloomberg Subdial Watch Index.

Almost every watch in the index was down in November.

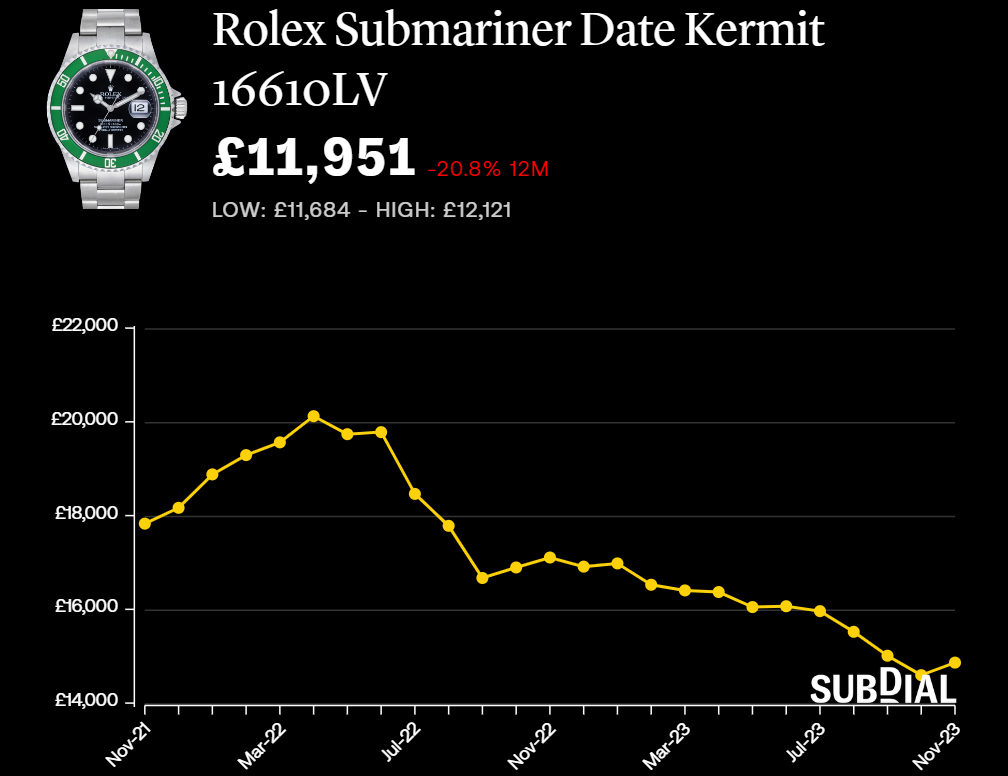

The discontinued black dial and green aluminium bezel Rolex Submariner Kermit ref. 16610LV was the biggest faller, down 4.6% in a month to £11,951.

The more modern, and still in the catalogue, black dial with green ceramic dialled Rolex Submariner, also known as the Starbucks, is given a current price of £12,406 on the index.

The current retail price for the Starbucks is £9,100.

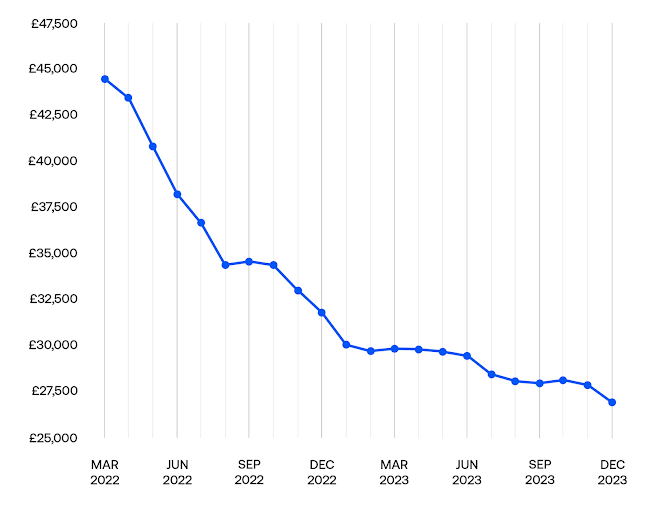

The secondary market saw prices stabilise in the first half of this year, after precipitous declines from the first quarter of 2022, but the downturn resumed in the summer, in part because waiting lists have been shortening for supply-constrained models.

Rising prices, which created the peak in Q2 last year, was largely driven by secondary market dealers trading watches at ever-higher prices among themselves.

When the market turned, this cycle went into reverse with dealers unwinding their inventories to a dwindling cohort of potential trade and end consumer customers.

November’s data from the Bloomberg Subdial Watch Index demonstrates how much of a buyers’ market we have been in since the start of the year.

The index is made up of the top 50 most traded watch references on the pre-owned market. It takes into account the latest market price of each model, and is weighted according to their sales value.

From peak to trough, the index price has almost halved from £45,000 in March 2022 to just over £27,000 today.

The greater the hype surrounding models at the peak of the market, the further they have fallen.

For example, the discontinued Patek Philippe Nautilus 5711/1A-010 (steel-on-steel three-hander with date, blue dial) was trading (or perhaps being advertised) for $185,000, according to the index. Today that price is under £100,000 on the Bloomberg Subdial Index, but that is a significant overstatement of the current market price.

The most recent 5711 to sell on Watchcollecting.com went for €65,000 (approx. £55,700) in May. Prices have been fairly stable since.

Another reference that had its price driven up when it was discontinued is the Audemars Piguet Royal Oak, which was trading for £138,000 at its peak.

The Bloomberg Subdial index says it is now selling for £64,000. Again, this is on the high side with the most recent online auction of the watch on Watchcollecting.com hammering at €50,350 (approx.. £43,200) in October.

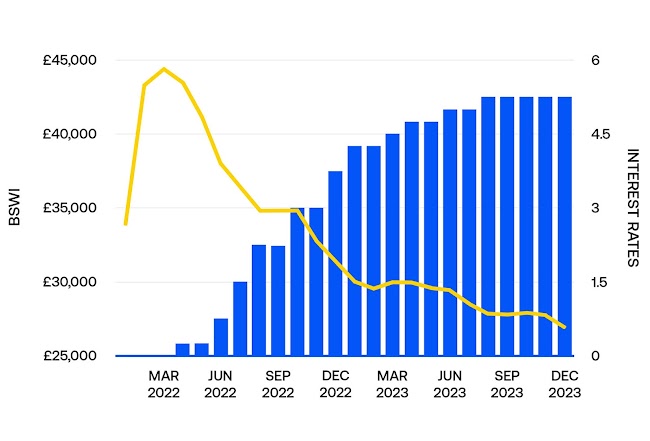

In commentary accompanying the latest data from the Bloomberg Subdial index, the pre-owned specialist suggests rising interest rates across the Western world choked demand, and that the end of fiscal tightening many feed through to firmer secondary market watch prices.

“The initial decline in the secondary watch market [in 20222] correlates almost perfectly with the start of interest rate increases from US Federal Reserve. But the correlation goes even deeper. The period between April and August [2023] saw larger rate increases — and steeper declines in the watch market. There was then a brief respite in both before another period of rate increases (and corresponding price declines) going into the end of the year,” Subdial suggests.

“As we look towards 2024, the potential for a soft landing of stable and eventually declining rates is reason for optimism in the watch market,” the commentary adds.

Subdial also points to the volume of watches being sold as a reason for optimism. “Watches are still being sold, just at sliding prices. This is in stark contrast to last year, when the market started to freeze as no one knew what the prices should be and chose to just wait,” it says.

Source : WATCHPRO